In recent times, there has been a surge in the availability and need for platforms offering instant loan. The rationale behind this occurrence isn't far-fetched, as instant loan platforms are generally faster and more approachable when compared to the traditional methods. This article streamlines the list of available options, living us with a list of 10 best apps to take instant loans without collateral in Nigeria.

Below are the 10 Best Picks:

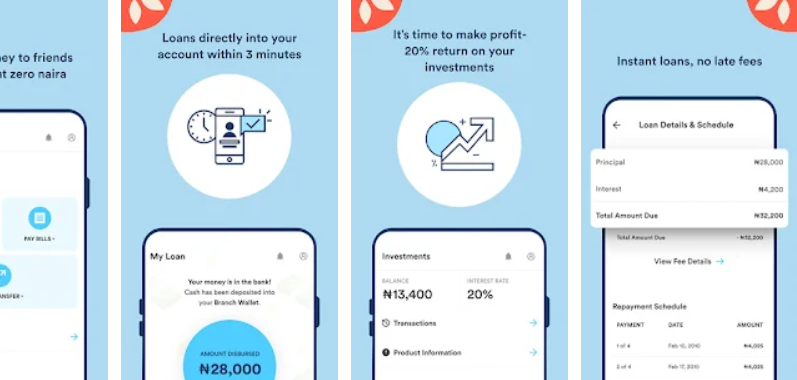

1. Branch

Branch is a fintech platform that offers both remote banking services, instant loans, and investment opportunities. it provides its offerings in a very intuitive user interface.

On the instant loan side, Branch offers between ₦2,000 to ₦500,000, with a repayments period that runs through 62 days to a year depending on the arrangement. The monthly interest on the loans acquired ranges from 1.7% to 22%, while yearly interest ranges from 20% to 265%.

Aside from offering instant loans, the Branch platform also offers banking services, with its selling feature being the fact that it doesn't charge any fee for transfers.

- No collateral needed

- Loans from ₦2,000 to ₦500,000

- 62 Days to 1 Year Repayment Periods

- 1.7% to 22% Monthly interest rate

- 20% to 265% Yearly Interest

- Invest Opportunity

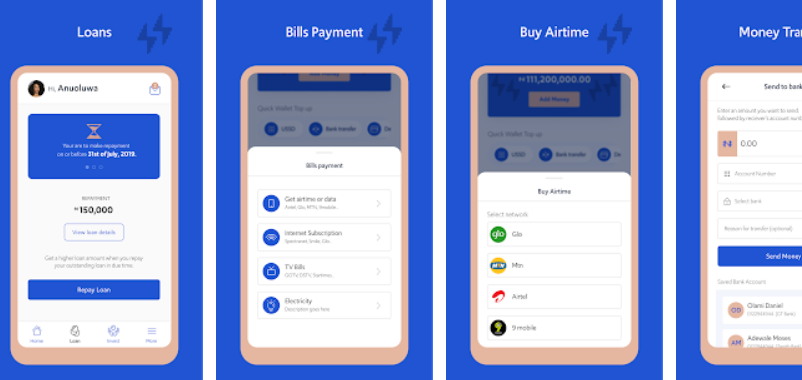

2. Aella

Aella happens to not only be available in Nigeria, but also in Ghana, and the Philippines. It is an instant loan provider, that offers loans between the range of ₦1,500 to ₦1,000,000. While its interest rate ranges from 2% - 20% monthly to 22% - 264% per annum.

Acquire a loan on the app isn't herculean, which is one of the advantages of patronizing instant loan platforms. You will be required to provide some basic information, alongside your BVN. Please note that loans taken from Aella are repayable between 91 days to 180 days.

In addition to offering instant loans, Aella also offers an investment page, health insurance (Aella Care), and also bill payment.

- No collateral needed

- Loans from ₦1,500 to ₦1,000,000

- 91 days to 180 days Repayment Periods

- 2% - 20% Monthly interest rate

- 22% - 264% Yearly Interest

- Investment Opportunity

- Health Insurance

- Available on Android and iOS

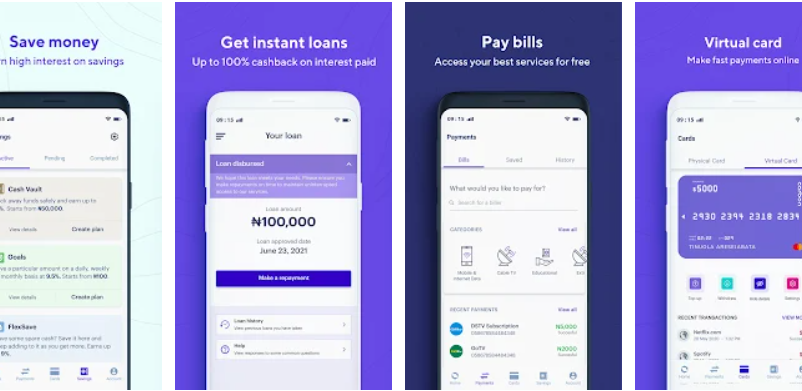

3. Carbon

To access credit services using the Carbon app, it is required that you provide your Bank Verification Number, alongside some other personal info. Users can borrow up to one million Naira with interest rates ranging from 1% to 60.8%, depending on the payback period and the amount borrowed.

Carbon also offers other services such as airtime recharge, financial transactions, and pay bills.

- No collateral Needed

- Loans from ₦1,500 to ₦1m in Nigeria and Ksh 500 to Ksh 30,000 in Kenya

- Maximum of 64 Weeks Repayment Period

- 1% - 21%Monthly interest rate

- 23% - 60.8% Yearly Interest

- Available on Android and iOS

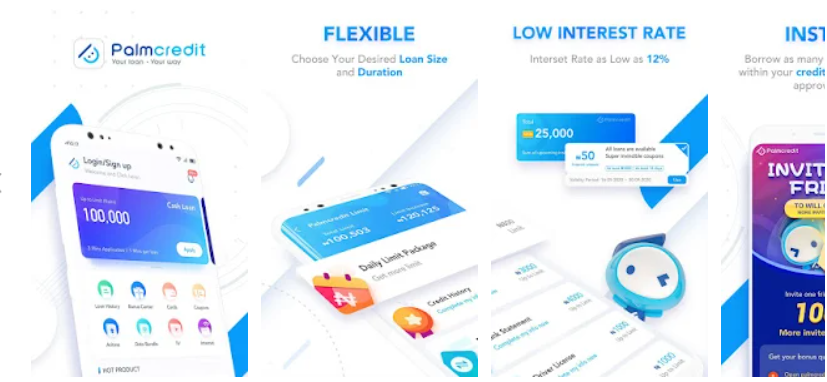

4. PalmCredit

Its intuitive name "Palm Credit" is one of the pointers to its service, bring loans to your fingertips. Palm Credit is legit one of the goto platforms, you can employ in acquiring the much-needed loan in no distant time. It all goes down within its intuitive design user interface.

Plam credit allows people to acquire instant loans from ₦5,000 to ₦300,000, which is expected to be paid 91days to 365days. The amount you are eligible to borrow is basically hinged on your credit score, which is determined by if you pay your loan on time.

- No collateral Needed

- Offers loans from ₦5,000 to ₦300,000

- 91days to 365days Repayment Period

- 4% - 4.7%Monthly interest rate

- 24% - 56% Yearly Interest

5. Kiakia P2P

Kiakia (Get if fast fast), as mentioned in the article, the main reason behind the surge in the need for instant loan platform is the absence of rigorous process. Loans are delivered as soon as possible.

Users who have decided to patronize kiakia platform can enjoy loans ranging from N10,000 and N100,000,000, with interest of 15% per month and per year.

- No collateral Needed

- Offers loans from ₦5,000 to ₦100,000

- 91 – 180 days Repayment Period

- 15% Monthly interest rate

- 180% Yearly Interest

- Available on iOS and Android

6. Soko Loan

Soko loan is a platform designed to take care of your instant loan needs and it does this in its intutive user interface. As at the time this article was written Loan seeks can get up to 100,00 Naira instant loan from the soko loan platform.

Loans have a repayment period of 91-180days and the loan range from 5,000 Naira to 100,000 Naira. Sokoloan monthly interest rate ranges from 4.5% – 34%, while yearly interest rate ranges from 29% - 365%.

- No collateral Needed

- Offers loans from ₦5,000 to ₦100,000

- 91 – 180 days Repayment Period

- 4.5% – 34% Monthly interest rate

- 29% - 365% Yearly Interest

7. Fairmoney

Still, on the topic of best apps to take loans without collateral, Fair money is another highly recommended app that allows people to take loans to solve needs, without having to go through a rigorous loan acquisition process.

Fair money allows enthusiasts to take loans from ₦1,500 to ₦500,000, with interest that ranges from 2.5% to 30% monthly and 30% to 260% yearly. repayments period runs through 61 days to 18 months.

Aiside from being an instant loan aquisition platfrom, fairmoney alos offers micro finance bank services and its funds are insured with the Nigeria Deposit Insurance Corporation (NDIC).

- No collateral Needed

- Offers loans from ₦5,000 to ₦300,000

- 91days to 365days Repayment Period

- 2.5% to 30%Monthly interest rate

- 30% to 260% Yearly Interest

- Microfinance Bank Seervices

8. QuickCheck

In Nigeria, QuickCheck provides fast loans of up to 500,000 Naira in minutes via the mobile app. However, as a first-time user, you are only able to access N10,000 for a 30-day period. Too acquire loans on the app, all you need to do is to secure your BVN and verify it, as other lending platforms do, and your approved loan disbursement bank account number.

Their terms and conditions for repayment indicate that early repayment promises a reduced rate of interest and access to better credits in the future. They have an interest rate of 2%-30%.

- No collateral Needed

- Offers loans from ₦1,500 to ₦500k

- 91 days - 1 year Repayment Period

- 5% Monthly interest rate on first loan, 2% - 30% Afterwards

9. Renomoney

You do not have to pass through herculean huddles to get cash to meet immeidate needs. This is the modulus operandi of the Reno moneyapp, as it lets you acquire quick loans fast and easily. It doesn't require collateral or guarantors. However, you will be required to pen down some particulars.

Aside from offering quick loan services, Reno Money offers a service that help you invest money for returns and also a service that allows you save your cash to attain future ambitions.

- No collateral or Guarantor Needed

- Offers loans from ₦6,000 to ₦6,000,000

- 3 to 24 months Repayment Period

- 2.5% to 30%Monthly interest rate

- 30% to 260% Yearly Interest

- Savings Platform

- Investment Opportunities

- Available on the Google Playstore

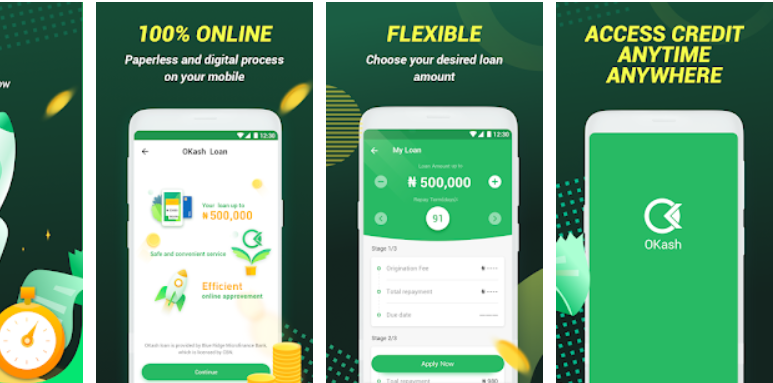

10. Okash

Okash is a sub-section of Opay and one of the most popular quick loans apps. In the past Okash was accessed via the Opay app however it recently become an indpendent entity that can be accessed via its own app.

To apply for credit using the Okash app, first, install it from the Google Playstore, then open it, register with your phone number, fill in your personal information after signing up, and then request for the loan. Applying for a loan with Okash is simple.

Okash offers loans ranging from 3,000 Naira to 500,000 Naira, with annual interest ranging from 36.5% to 360% and repayment period from 91 days to 365 days.

- No collateral or Guarantor Needed

- Offers loans from ₦3,000 to ₦500,000

- 91 days to 365 days Repayment Period

- 36.5% to 360% Yearly Interest

- Available on the Google PlayStore

Wrapping up:

There you have it - a comprehensive list of best apps to take instant loans without collateral in Nigeria. Please note that a delay in clearing the loans after the due date will lead to a drop in your credit facility which will hinder you from having higher loans.

Also you should not that measures have been put in place to destroy your integrity in times when you refuse to pay up the acquired loans. So its best you pay up to allow the system run smoothly.